If you’re thinking about doing some delivery work with Uber Eats, DoorDash, Menulog, or other delivery platforms in Australia, you’ll need to get something called an Australian Business Number, or ABN for short.

Basically, an ABN is this 11-digit number that helps the government and the community know that you’re running your own little business, even though you’re working as a delivery driver.

The reason you need it is that when you’re delivering for these online platforms, you’re not an employee – you’re more like a contractor running your own independent business. So, you’ve got some legal stuff to take care of, just like a regular small business owner.

ABN requirements for gig delivery platforms

The Australian government says that if you wanna be a delivery driver, no matter which company you work for, you should have an ABN number.

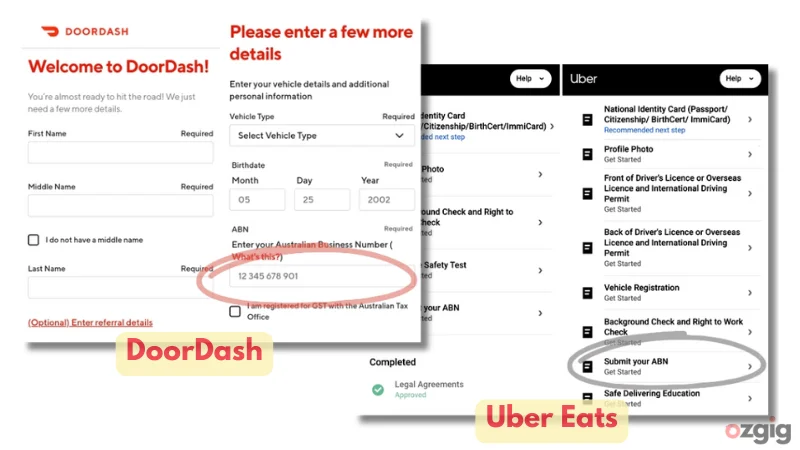

When you register as a DoorDash delivery driver or sometimes called as Dasher, either on their website or the app, you’ll see a spot where you can write down your ABN after you pick your vehicle and enter your birthday.

For Menulog, you can find all the info about this requirement on their official website in the Courier Help Center. And when you sign up through their app or website, they’ll ask you to enter your ABN right after you upload your ID and vehicle details.

Uber Eats delivery driver need to put their ABN number either on their website or through the driver app. You can find where to enter your ABN during the registration process.

Detailed instructions for applying ABN for

Applying an ABN for DoorDash or Uber Eats is not too complicated, and I will try to help you get all set up to start making some extra cash with your delivery work. Let me break this down for you step-by-step.

1. Visit Australian Business Register website

Head over to the Australian Business Register (ABR) website www.abr.gov.au/…/applying-abn and look for the button or link to apply for or renew your ABN.

2. Agreement page

Next, you’ll see an agreement page, and all you need to do is tick the box to indicate that you agree. Then simply press the next button.

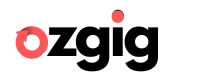

3. ABN Entitlement

The answers to the following queries will help ascertain your eligibility for an ABN. It’s critical that you choose the answer that best describes your current situation.

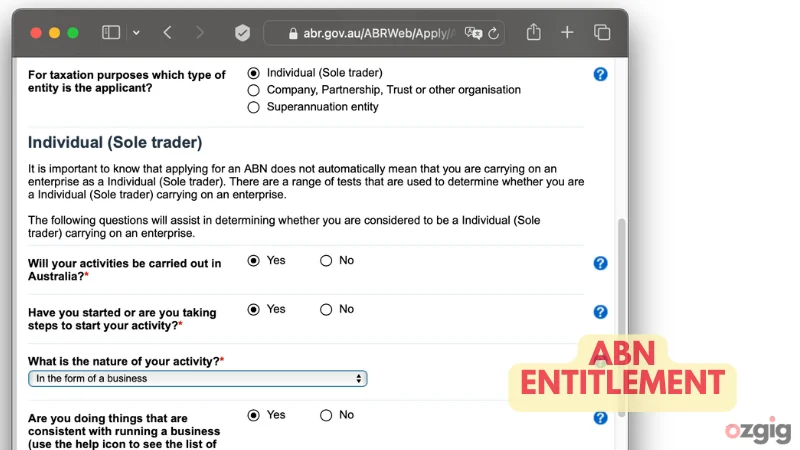

4. Application Detail

More specific information regarding your ABN application will be asked in this section.

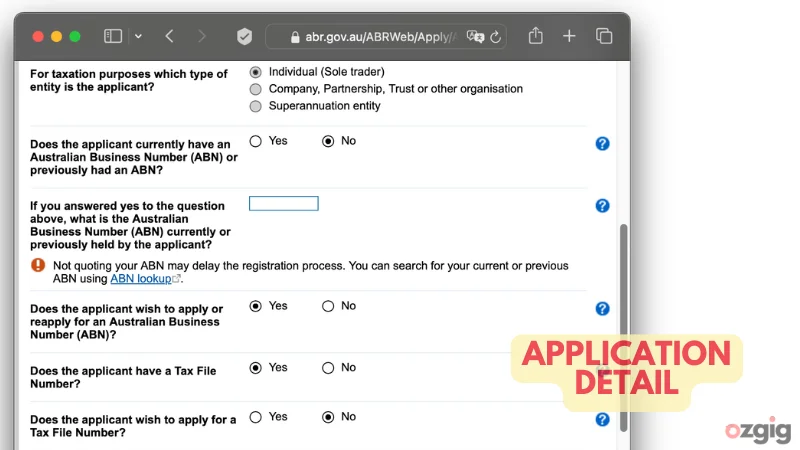

5. Business Information

In this step, which is the most time-consuming of the entire application step, will go further into additional details about the business you run.

Taxation Information

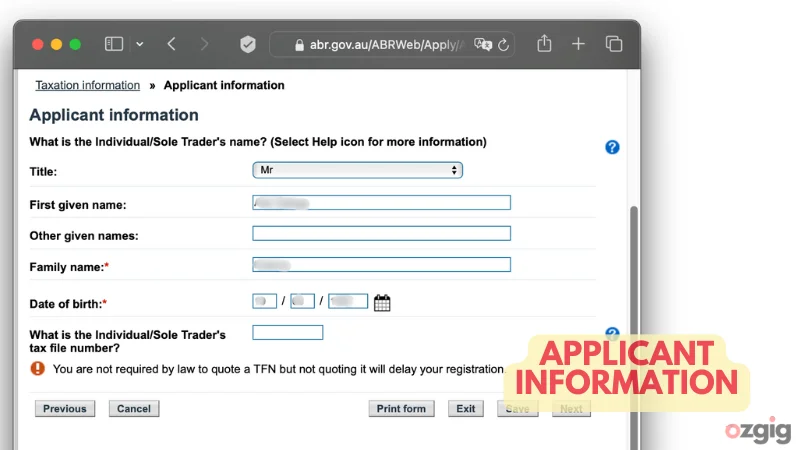

Applicant Information

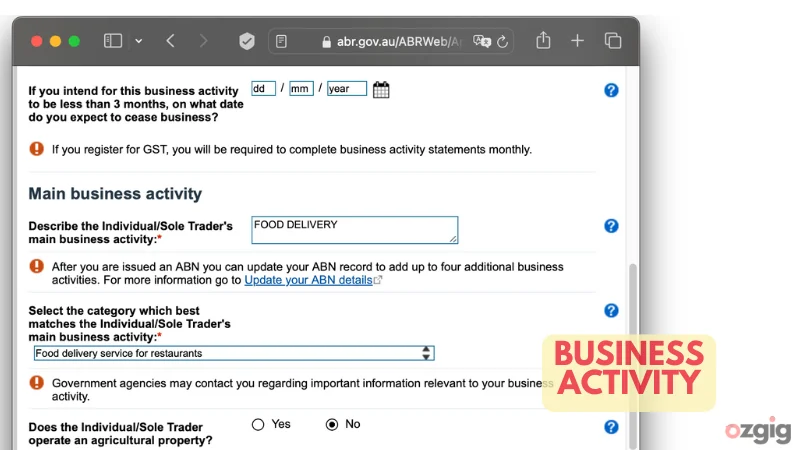

Business Activity Details

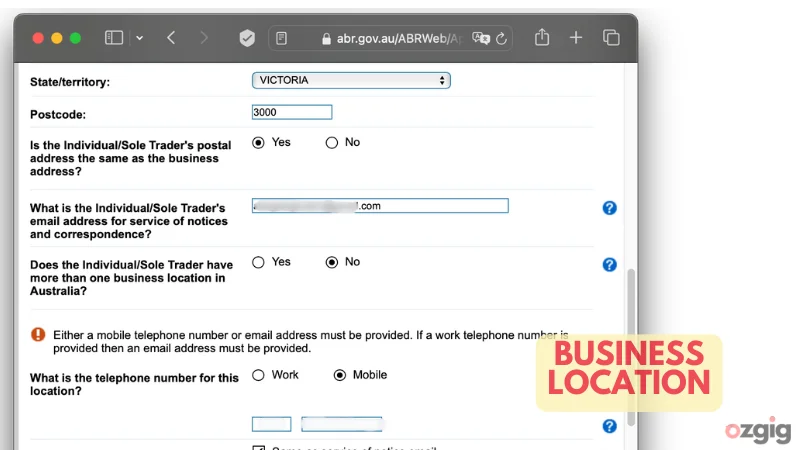

Business Address Details

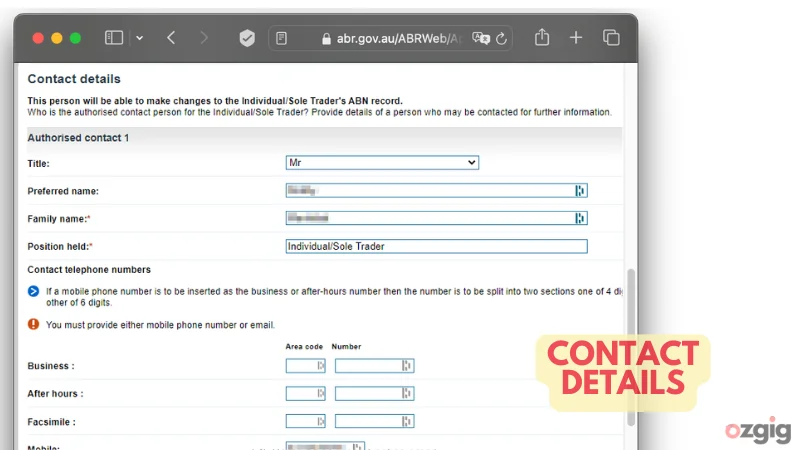

Contact details

This is the Individual/Sole Trader’s designated contact person. You need to provide your contact information, so they can reach out to you if they need anything else.

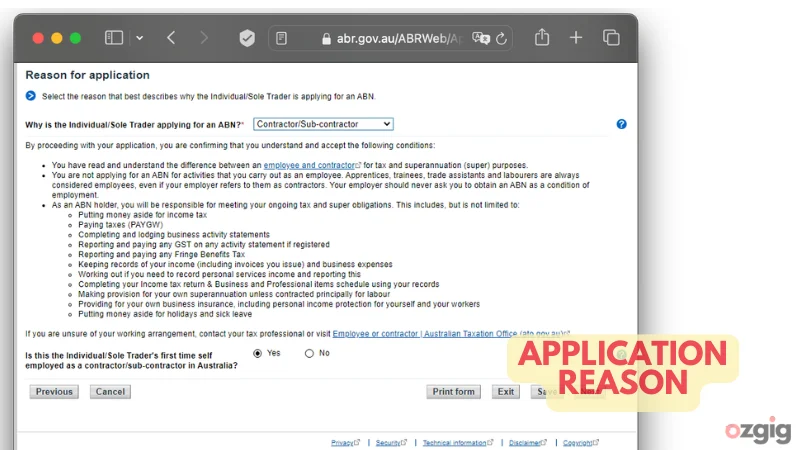

Reason for Application

In this part, you should be able to explain why you, as a sole trader, are seeking for an ABN.

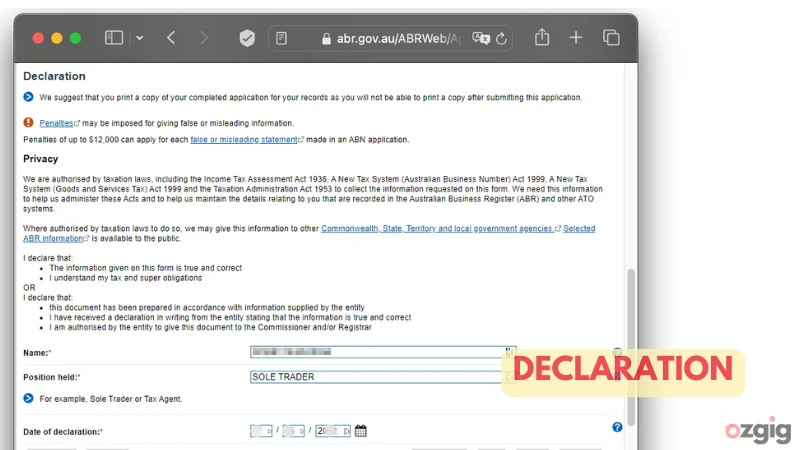

Declaration

This is the final and crucial stage of the entire application stage. Please examine the declaration form and privacy statement meticulously, taking the time to fully comprehend their contents.

Once the system has successfully identified and verified all the details you have provided, your Australian Business Number (ABN) will be issued promptly, without any further delays. It can be used right away to sign up for delivery services like Uber Eats and DoorDash.

However, in some instances, the Australian Business Register (ABR) may require additional time to validate and process your application. During this period, the ABR may reach out to you directly, seeking any supplementary information or clarification necessary to finalize your request.