A fortnightly payroll cycle is a typical payroll cycle commonly used by several companies in Australia. This means workers will be paid every two weeks. Most gig economy platforms implement weekly payments as their standard.

However, due to the demand for more flexible payment options in the gig economy ecosystem, many gig delivery companies, such as DoorDash, have recently started offering daily payments to their drivers.

Fast and flexible payouts are an important aspect of the gig economy. This is closely related to worker retention and business competition. Most gig workers will prefer a platform that lets them access their earnings whenever they want.

Australian DoorDash driver payday

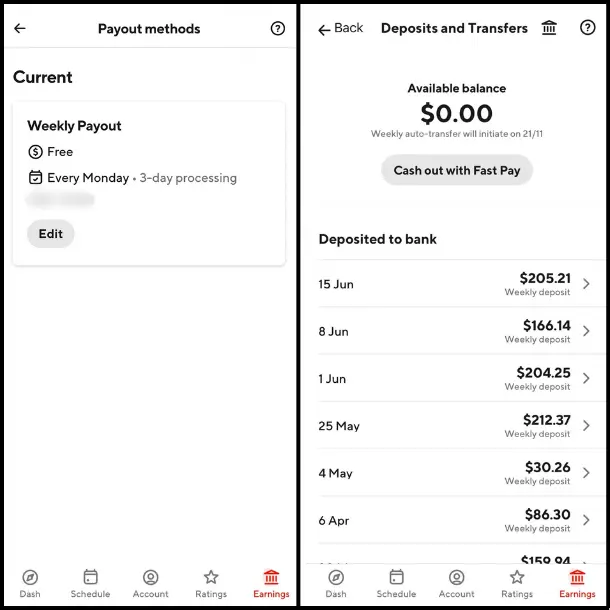

Delivery drivers on DoorDash also known as Dashers will be paid on a weekly basis. Earnings earned from completed deliveries on Monday – Sunday (till midnight) will be paid on Monday.

DoorDash will initiate automatic weekly direct deposit payments every Monday, but the speed at which the money reaches your account depends on how quickly the bank you use processes it.

Dashers in Australia can use whatever bank account they have as long as the bank is officially operating in the country. Some banks that fellow Dashers often use are ANZ, Commonwealth Bank, NAB and Westpac.

DoorDash driver daily payment

The standard weekly payment basis for some gig drivers is considered less flexible. Especially for those who live paycheck to paycheck who usually rely on their daily earnings to cover their daily expenses, including unexpected expenses such as vehicle repairs or other emergencies.

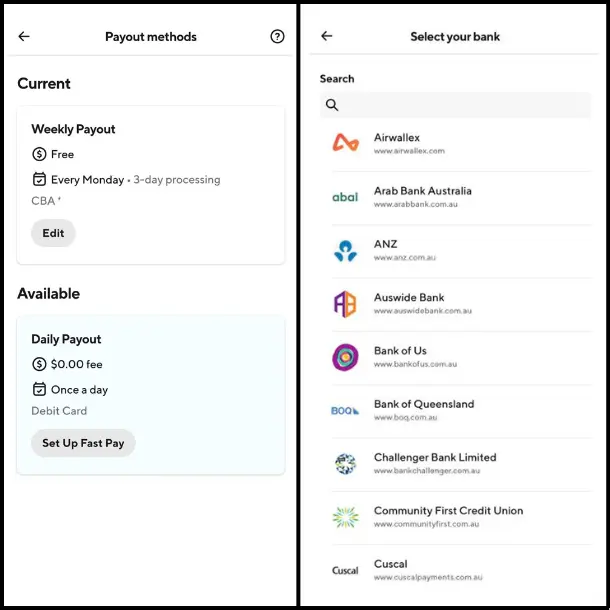

Luckily DoorDash finally offers a daily payment option in Australia which was introduced as Fast Pay. A payment option that enables Dashers to cash out their daily earnings without a fee.

To be able to take advantage of Fast Pay, Dashers must have a debit card issued by the bank they use. However, not all banks operating in Australia are supported by Fast Pay.

You can see the latest list of banks supported by Fast Pay when you activate this payment option within the Dasher app. Unfortunately, some popular banks among Aussies cannot take advantage of this feature. For example, CommBank, Westpac, NAB and Citibank.

So, if you still want to take advantage of daily instant cash out then you have to open a new account at a supported bank. There are many banks that support Fast Pay, but the banks that are most used by Dashers are ANZ, ING, Suncorp, HSBC, Heritage and others.

For your information, you can have 2 different bank accounts for one Dasher account. So, the first bank account for weekly direct deposit and another bank account supported by Fast Pay. For example, using the Commonwealth Bank for weekly payments and ANZ for Fast Pay.

Don’t want to have lots of bank accounts? Don’t worry, you can use a debit card issued by Wise (previously known as TransferWise) to receive Fast Pay. You can immediately withdraw your cash balance or use it for transactions at merchants that accept Mastercard or Visa debit cards.

After you add your debit card to Fast Pay for the first time or update the debit card that is on file, Fast Pay will be disabled for 7 days. This is a precautionary measure by DoorDash’s security system to protect your account.

Apart from that, there are also several conditions for new Dashers who want to activate this payment option, they must complete their first 25 deliveries and be active on the platform for at least 14 days.

How long does it take for money to reach the bank?

Dasher’s payments will be transferred directly to a pre-arranged bank account and may take up to 3 days to process. So, weekly payments via direct deposit will be received by Dashers anytime between Monday and Wednesday.

Depending on the bank used most fellow Dashers in Australia said that their money had arrived on Monday midday to early afternoon. If not, it would arrive the next day, or worst case Wednesday.

For Fast Pay, most payments will be received instantly within minutes, although sometimes the bank may take a few hours to process and send the money to your debit card.

However, when payday falls on bank holidays, Dashers can expect delays in receiving their pay, be it weekly deposits or fast pay. Rest assured, if there are no other inhibiting factors, this delay will not exceed Wednesday for weekly deposits or more than a day for fast pay.

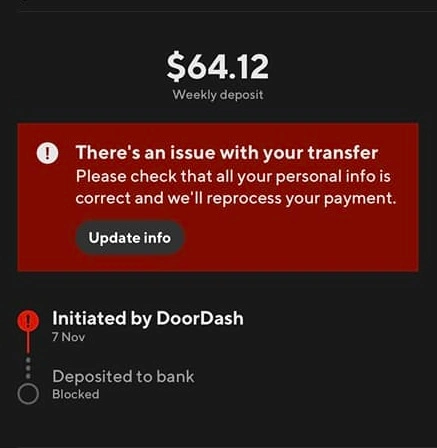

DoorDash Payments Failed – Deposited to Bank blocked

Some fellow Dashers in Australia are getting a “There’s an issue with your transfer” notification on the Dasher app (Earnings section) with the additional message Deposited to bank blocked. When a delivery driver gets a notification like this, he won’t get his money until the problem is resolved.

Interestingly, this often happens on a Dasher’s first payment. After further investigation, the issue actually does not originate entirely from DoorDash, but from the third-party payment provider, Stripe, which processes automatic direct deposits to Dashers every week.

As a financial service, Stripe is required to collect, verify and maintain identity information on the individuals associated with a Stripe account. These requirements were issued by the Australian government to prevent abuse of the financial system.

If Stripe is unable to programmatically verify a driver’s identity (which is uploaded when signing up to become a Dasher), the driver will be asked to provide a government-issued picture ID or other document via the secure Stripe dashboard.

You will be prompted in-app to upload your docs if this is the case. If you do not receive this kind of prompt or pop-up. You can try logging out of the Dasher app and then logging back in. The pop-up should appear a few moments after you successfully log in again.